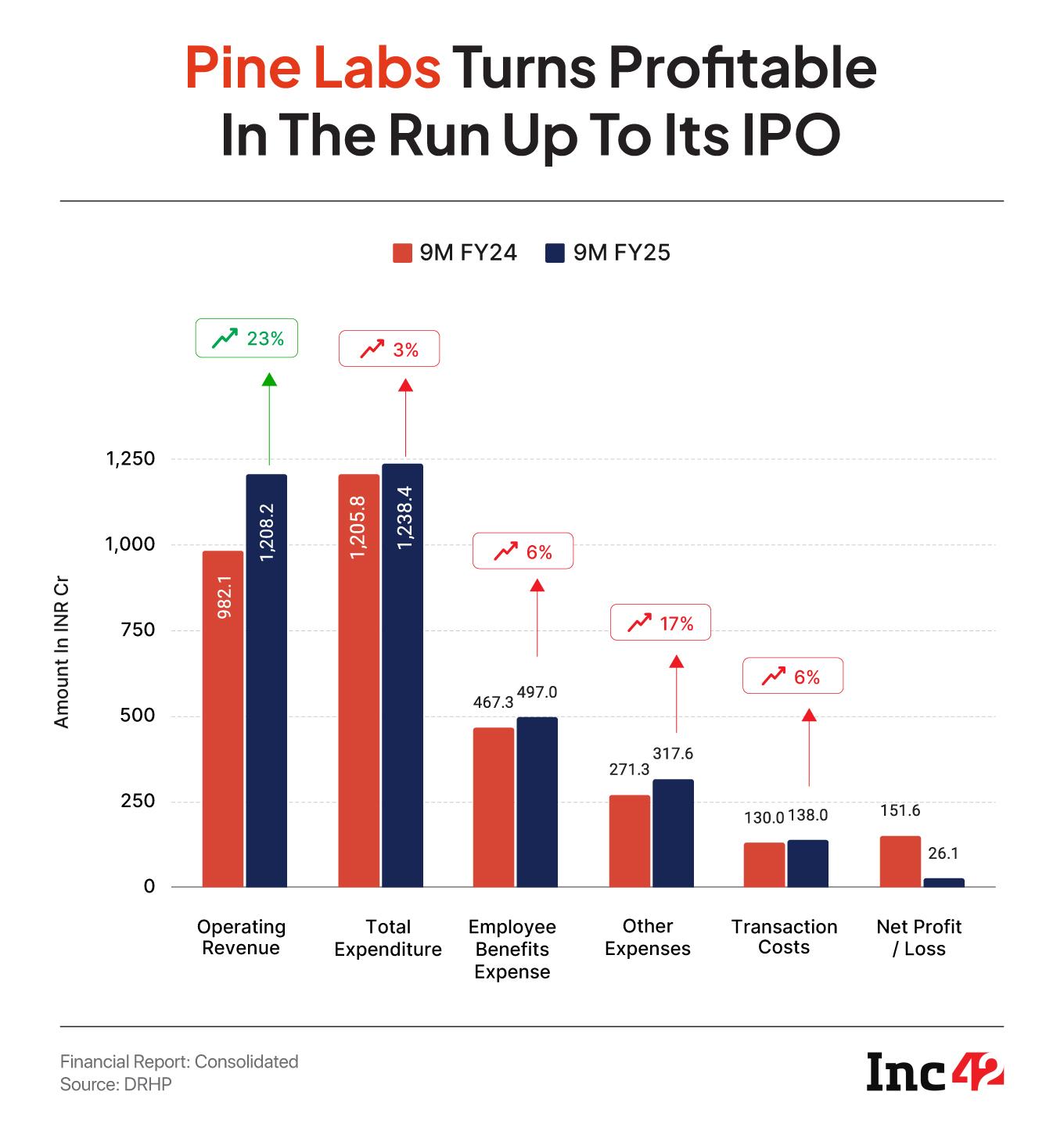

As has been the case with most of the IPO-bound new-age tech companies, fintech major Pine Labs turned profitable in the first nine months of FY25 (9M FY25). The company reported a net profit of INR 26.1 Cr as against a loss of INR 151.6 Cr in the same period last fiscal.

The improvement in the bottom line came on the back of a surge in its top line. In 9M FY25, the company’s operating revenue jumped 23% to INR 1,208.2 Cr from INR 982.1 Cr in the year-ago period. Including an other income of INR 65.7 Cr, Pine Labs’ total income for the period surged 27% YoY to INR 1,273.8 Cr.

At the end of 2024, Pine Labs had 9.2 Lakh merchants, 666 consumer brands and 164 financial institutions using its products. In 9M FY25, the company processed payments worth INR 7.5 Lakh Cr through 397 Cr transactions on its platform.

The fintech company, which has been in the business for 27 years, filed its IPO papers last week. The public issue will comprise a fresh issue of up to INR 2,600 Cr and an OFS component of up to 14.8 Cr, which would see investors like Peak XV Partners, Actis VC, Mastercard, among others, offload their shares.

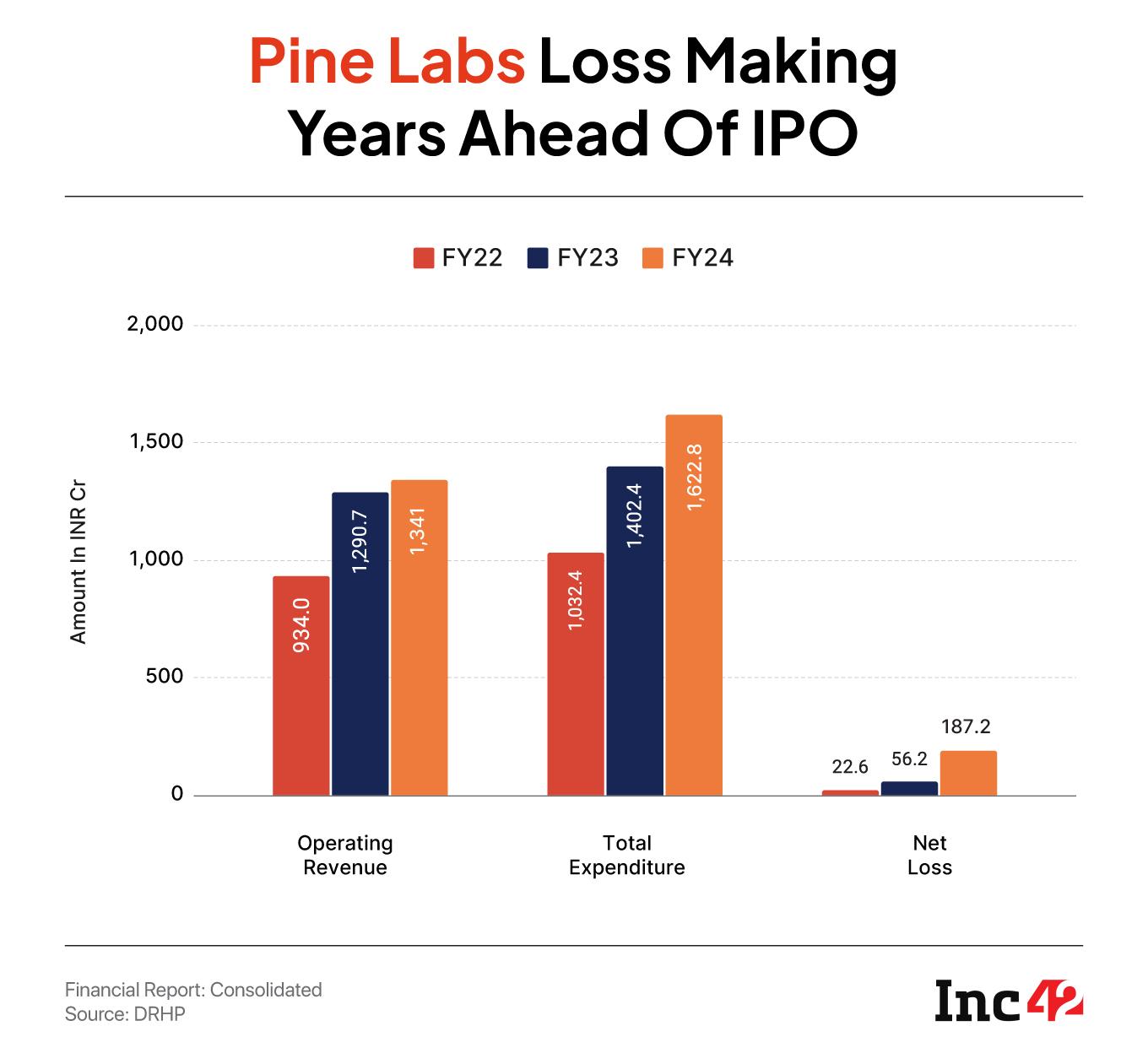

While Pine Labs managed to turn profitable leading up to the IPO, it remained a loss-making entity in the previous three full financial years. In FY24, the company’s loss zoomed over 3.2X to INR 240.2 Cr from INR 74.8 Cr in the previous year. Operating revenue rose 4% to INR 1,341 Cr in FY24 from INR 1,290.7 Cr in FY23.

Notably, Pine Labs’ operating revenue in 9M FY25 was just 10% lower than its revenue in the entire FY24.

Founded in 1998 by Lokvir Kapoor, Tarun Upadhyay and Rajul Garg, Pine Labs initially started as a card-based payment and loyalty solutions provider focussed on the retail petroleum industry. Back then, it developed solutions for automating retail operations at petrol stations.

By the mid-2000s, the company pivoted its business to become a point-of-sale (PoS) technology provider, given the emerging need for better payment solutions in the broader retail sector.

It gradually expanded its arsenal of products to include a broader range of payment and merchant services, including PoS terminals, payment gateways, and buy-now-pay-later (BNPL) solutions.

The company established its cloud-based tech platform in 2012 to simplify in-store check-outs for merchants. The next year, it took its solution to consumer brands, enterprises, and financial institutions.

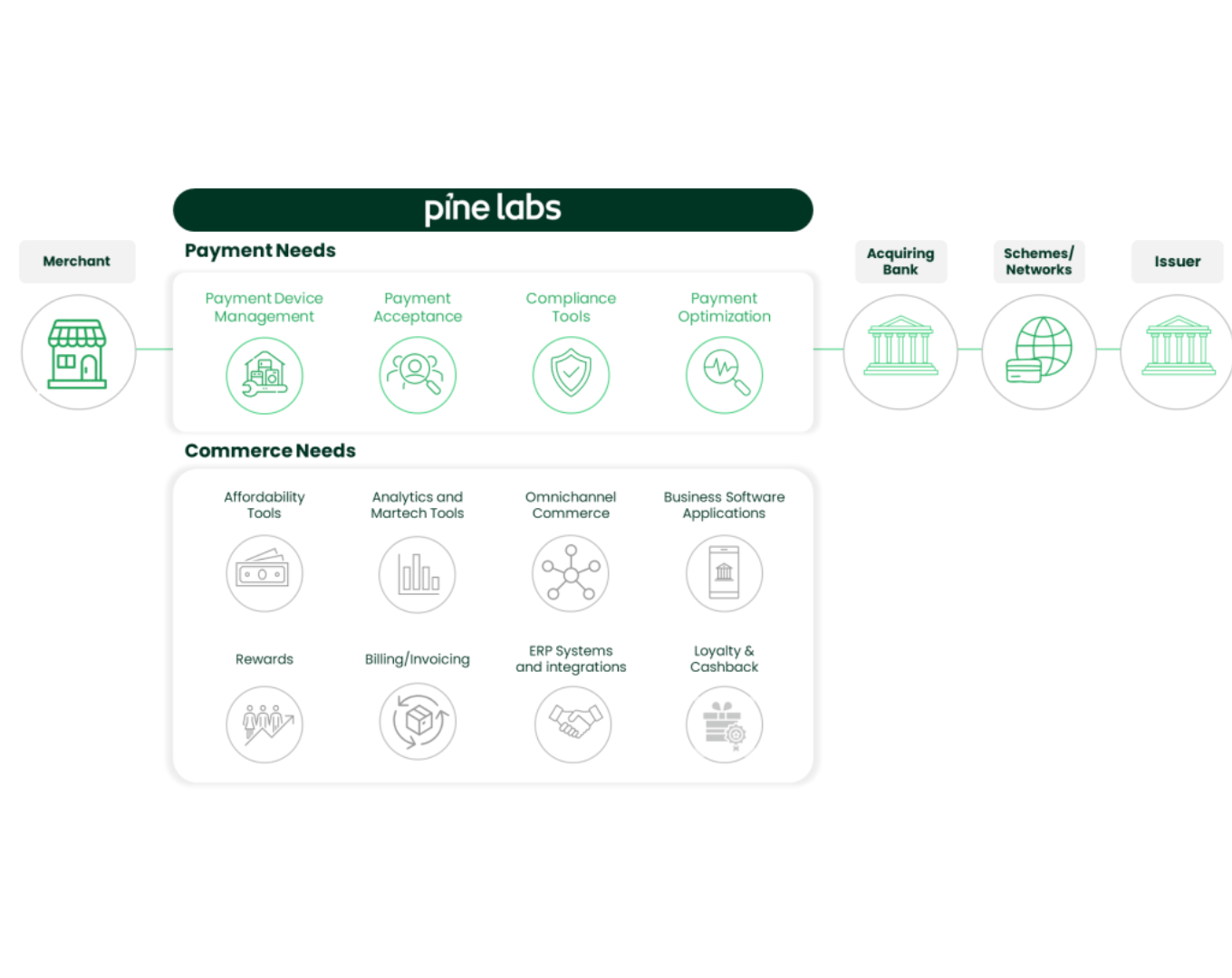

As per its DRHP, the PoS business that enables payments acceptance at merchant stores is the key revenue driver for the company. The company also offers issuing and acquiring solutions to financial institutions, enabling issuance of credit cards, debit cards, prepaid cards and forex cards to consumers.

The fintech company also allows workflow integration systems, which lets merchants integrate digital payments with billing systems, rewards, loyalty programme management, among others.

Over the years, Pine Labs also made multiple acquisitions to either enter new business segments or strengthen its existing suite of offerings. These include:

— It acquired Qwikcilver (now Pine Labs Prepaid) in 2019 to enter the prepaid cards segment. In 9M FY25, the company issued 47.45 Cr prepaid cards as against 39.1 Cr in the same period last year.

— Payment solutions provider Mosambee was acquired by the fintech major in a deal valuing the former at over $100 Mn in April 2022. With the acquisition, Pine Labs aimed to expand its in-store and online payment offerings and affordability solutions via the acquisition.

— The company acquired Mumbai-based online payments startup Qfix Infocomm to enable smooth commerce transactions and digitising small and medium sized merchant transactions.

— Pine Labs acquired fintech infrastructure company Setu in June 2022 for an estimated $70 Mn to $75 Mn to provide API-enabled technology platform for digital public infrastructure across payments.

—The company expanded its solutions for financial institutions by the acquisition of Credit+ in 2023, through which it offers full-stack issuing solutions, acquiring and transaction processing software enabling financial institutions to offer credit, debit, prepaid and forex cards and manage the life cycle of their consumers.

With the expansion of its business, the company has expanded its geographical presence as well over the years. It has presence in India, Malaysia, the UAE, Singapore, Australia, the US and Africa.

However, Pine Labs’ operations from outside India raked in only INR 34.4 Cr or about 3% of its revenue.

The company intends to expand its overseas business post getting listed in India. Pine Labs plans to use INR 60 Cr out of the INR 2,600 Cr fresh issue to invest in its Singapore, Malaysia and UAE subsidiaries.

“By expanding our operations in the aforesaid international markets, we expect to be able to scale our existing operations, strengthen our partnership ecosystem, and drive broader adoption of our product suite, while maintaining our commitment to ongoing technology investments,” its DRHP read.

Pine Labs’ Revenue Breakdown Digital InfraFor 9M FY25, a large chunk of the company’s business came from its digital infrastructure and transaction platform. It accounted for INR 853.8 Cr out of Pine Labs’ total operating revenue of INR 1,208.1 Cr. To note, the segment’s revenue grew 28% from INR 666.1 Cr in 9M FY24.

The company’s digital infra platform comprises in-store and online payments infrastructure for its consumer-facing business customers. The platform’s gross transaction value for the time period surged 68% YoY to INR 7.5 Lakh Cr

For context, it acts as a digital funnel between the merchant and the banks that the transaction involves. Merchants get to consolidate multiple acquirers on to a single platform which is integrated within their billing software.

Source: DRHP

Source: DRHP

The company’s in-store payments platform is operational in India, Malaysia and the UAE and its online payments platform is currently operational in India. It’s used by brands like DMart, Lifestyle, Samsung, Flipkart, among others.

For in-store payments, the company primarily earns revenue from merchants and acquiring banks, who pay subscription fees based on the number of devices they use. In case of online payments, Pine Labs earns a fee from merchants which is calculated based on the value of transactions that are processed on the platform.

Further, its affordability solutions are integrated into the digital infrastructure and transaction platform workflows, connecting merchants and major consumer brands that offer promotions and financial incentives to consumers with lenders.

The company also offers fintech infrastructure to financial institutions, which use it to manage the life cycle of a consumer, including onboarding, underwriting, collections, and engagement. The customers of this offering include the likes of SBI Payments, ICICI Bank, American Express, among others.

Pine Labs earns revenue from these institutions through transaction-based fees charged on the basis of the number of transactions the platform processes across bill payments.

Issuing & Acquiring PlatformThe second revenue stream for the fintech major contributed INR 354.4 Cr to its top line in 9M FY25, up 12% from INR 316 Cr in the same period last year. The platform’s gross transaction value (GTV) jumped 36% YoY to INR 38,279 Cr.

The platform enables consumer brands and enterprises to create prepaid products that help them drive sales. For financial institutions, it enables issuance of credit, debit, forex cards and prepaid instruments to the end consumers.

Pine Labs primarily earns processing fees based on GTV processed or distributed through its platform.

Where Did Pine Labs’ Spend In 9M FY25?

The company’s total expenses for the time period stood at INR 1,238.4 Cr, up a meagre 3% from INR 1,205.8 Cr in 9M FY24. Here’s a brief breakdown of the company’s expenses:

Employee Benefits: Pine Labs spent INR 497.1 Cr on its employees in 9M FY25, up slightly from INR 467.3 Cr in the same period previous year.

Other Expenses: Expenses under this bracket stood at INR 317.6 Cr, up 17% YoY. These expenses included spending on data centre and cloud storage, IT, advertising, among others.

Transaction Costs: The company spent INR 138 Cr under this bracket, up 6% from INR 129.7 Cr in the same period of previous year.

[Edited by: Vinaykumar Rai]

The post Decoding IPO-Bound Pine Labs’ Revenue Model appeared first on Inc42 Media.

You may also like

What's going on with the iconic dancing fountain of Dubai? it's been dry since April!

Noel and Liam Gallagher in never-before-seen childhood snaps ahead of Oasis reunion

Crisis in Majorca and Menorca as tourists face closed restaurants - 'Can't be ignored'

BBC News host skewers squirming Liz Kendall on air after humiliating blow for Starmer

Chaos in UK seaside town as girl rushed to hospital after huge brawl on beach